Content

As the name implies, a market maker will make a market for certain financial instruments. Typically, the market maker pay for order flow will offer a better price than is available on a public exchange. The Securities and Exchange Commission (SEC) fined Robinhood $65 million in late 2020 for routing trades to market makers that didn’t offer the highest price, and also for misleading its customers as to what was going on.

Lower commissions and fees, price improvement

Back to our example, your buy market order for 100 shares of company XYZ arrives 10 milliseconds before another trader wants to sell 100 shares of company XYZ by using a market order. Typically you would get filled at the next best ask at $106, and https://www.xcritical.com/ he at the next best bid at $105.5. But the venue now maps both orders using their algorithms and shares the profit made.

Payment for order flow: How it works and why it matters

But we can’t say for certain which broker has the fastest execution, because internet connectivity plays a very large role. Complete digital access to quality FT journalism with expert analysis from industry leaders. Selling order flow has become one of the primary sources of income for U.S. TD Ameritrade and Robinhood dominate the market, while Webull shows the most significant percentage growth.

Payment for order flow—What you need to know

The Order to Cash (O2C) process is a critical part of businesses as it captures all steps from order placement to cash payment. The O2C cycle impacts significant business processes like financial and operational efficiency and customer experience. Blain Reinkensmeyer has 20 years of trading experience with over 2,500 trades placed during that time. He heads research for all U.S.-based brokerages on StockBrokers.com and is respected by executives as the leading expert covering the online broker industry. Blain’s insights have been featured in the New York Times, Wall Street Journal, Forbes, and the Chicago Tribune, among other media outlets.

For additional information about rates on margin loans, please see Margin Loan Rates. Security futures involve a high degree of risk and are not suitable for all investors. Before trading security futures, read the Security Futures Risk Disclosure Statement. Structured products and fixed income products such as bonds are complex products that are more risky and are not suitable for all investors.

He holds the Chartered Financial Analyst (CFA) and the Chartered Market Technician (CMT) designations and served on the board of directors of the CMT Association. Some brokers might claim they don’t accept PFOF, but they trade against you instead. Operating a market maker and using an algorithm to pick and choose which customer orders you want to bet against certainly sounds like a losing proposition for the customer.

Brokerage customers can ask for payment data for specific transactions from their brokers, though it could take weeks to get a response. Regulation NMS, through its Rules 605 and 606, also requires broker-dealers to make two reports available, one to disclose the execution quality and the other to give the payment for order-flow statistics. For instance, regulations already require brokers to search for the best trades for their clients. While some have suggested that the SEC should do more on this front, it’s not too difficult for regulators and individual clients to assess because the data for trades executed can be compared with the posted spreads. The purpose of allowing PFOF transactions is liquidity, ensuring there are plenty of assets on the market to trade, not to profit by giving clients inferior prices.

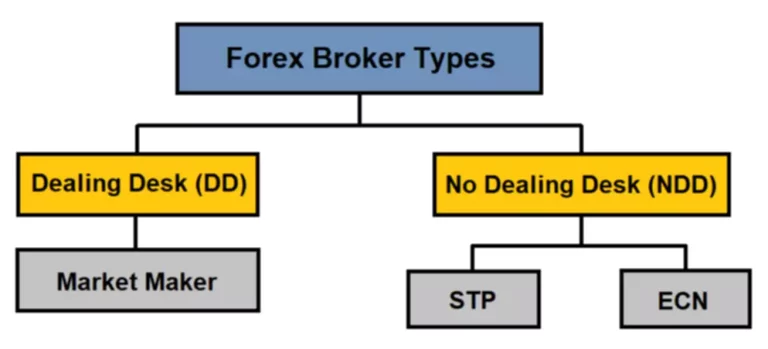

But with multiple trading venues and when trades are matched within milliseconds, it’s not easy to prove (or disprove). Going back to the world of retail trading, PFOF works in a similar way. Payment for order flow is compensation received by a brokerage firm for routing retail buy and sell orders to a specific market maker, who takes the other side of the order. (In other words, market makers become the seller to your buy order or buyer to your sell order). The money that market makers collect from PFOF is usually fractions of a cent on each share, but these are reliable profits that can turn into hundreds of millions in revenue a year.

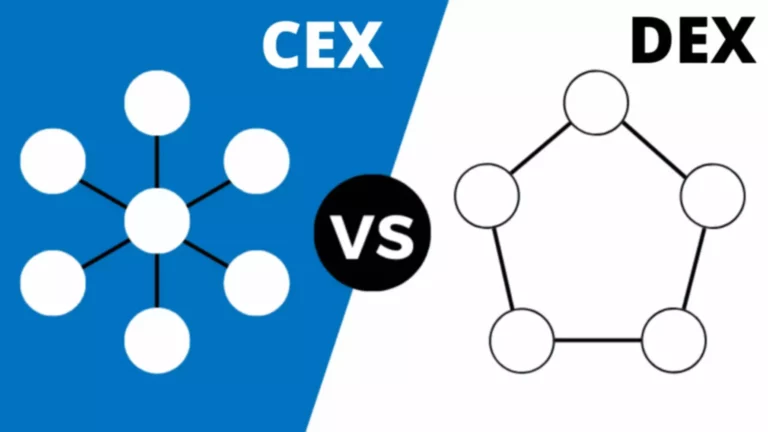

How are brokerages generating so much revenue while offering commission free trades? In the PFOF model, the investor starts the process by placing an order through a broker. The broker, in turn, routes this order to a market maker in exchange for compensation. The market maker then executes the order, aiming to profit from the spread or other trading strategies. Changes in the complexity of trades involving equity, options, and cryptocurrency have come about as exchanges and electronic communication networks have proliferated. Market makers are entities, typically large financial firms, that provide liquidity to the financial markets by buying and selling securities.

The lack of proper technology to automate and optimize order fulfillment processes can pose a significant challenge. Without integrated systems such as warehouse management software, e-commerce order tracking, and automation tools, scaling and maintaining efficiency in order fulfillment becomes difficult. A retailer might fulfill everyday items internally but use third-party services during peak seasons while shipping large furniture directly from manufacturers.

Output from Alpha should not be construed as investment research or recommendations, and should not serve as the basis for any investment decision. All Alpha output is provided “as is.” Public makes no representations or warranties with respect to the accuracy, completeness, quality, timeliness, or any other characteristic of such output. Please independently evaluate and verify the accuracy of any such output for your own use case. Investment Plans (“Plans”) shown in our marketplace are for informational purposes only and are meant as helpful starting points as you discover, research and create a Plan that meets your specific investing needs.

This guide ranks the top brokers of 2024 that don’t accept PFOF, highlighting those committed to transparent, client-first order routing. By eliminating revenue from market makers, these firms raise the bar for execution quality, potentially giving active traders a pricing advantage. For investors who value optimal trade execution, these brokers represent a superior choice. In the world of zero-commission trading, it’s natural to wonder how brokers keep their doors open. For many brokers, one of the primary revenue sources is payment for order flow (PFOF), a practice where brokers receive compensation for routing your trades through specific market makers. While PFOF has sparked debate among investors, it remains a core revenue model for many of the leading platforms.

In fact, SEC Chair Gary Gensler said after the Gamestop saga that payment for order flow can raise real issues around conflicts of interest. Market makers, who act as buyers and sellers of securities on behalf of an exchange, compete for business from broker-dealers in two ways. First, they compete using the price they can buy or sell for; and, second, they consider how much they are willing to pay to get the order. According to the SEC, Robinhood sold order flow to the market maker that gave it the best rebate rather than the one that offered the best price for Robinhood’s clients. In this example, the market maker would make only a $0.03 profit on the orders, but market makers process millions of orders a day. The SEC proposed Rule 615, the “Order Competition Rule,” which would require broker-dealers to auction customer orders briefly in the open market before executing them internally or sending them to another trading center.

Citadel Securities, Susquehanna International Group, Wolverine Capital Partners, Virtu Financial, and Two Sigma are among the largest market makers in the industry. And the top three within that group—namely, Citadel, Susquehanna, and Wolverine—account for more than 70% of execution volume in the markets. These and other market makers use high-frequency algorithms that scan exchanges to compete fiercely for orders. Rebate rates vary monthly from $0.06-$0.18 and depend on your current and prior month’s options trading volume. This rebate will be deducted from your cost to place the trade and will be reflected on your trade confirmation. To learn more, see our Options Rebate Program Terms & Conditions, Order Rebate FAQ and Fee Schedule.

This third party is known as a market maker and are large financial institutions, such as Citadel Securities, that provide liquidity to the market by both buying and selling securities. More recently, fierce competition among discount brokers pushed trading commissions steadily lower. By the late 2010s, many brokers had eliminated training fees altogether. Brokers’ commissions have changed with the rise of low-cost alternatives and online platforms. To compete, many offer no-commission equity (stock and exchange-traded fund) orders.

- As trades are made, data flows from public exchanges and aggregates into a listing known as the NBBO, or National Best Bid and Offer.

- Complete digital access to quality FT journalism with expert analysis from industry leaders.

- This is a bracket, which represents the highest prices buyers are willing to pay, the bid, and the lowest prices sellers are willing to sell, known as the ask price.

- Lastly, many institutional traders do not want to show their orders at the exchanges for fear of driving the price away from themselves.

- How are brokerages generating so much revenue while offering commission free trades?

- Do not infer or assume that any securities, sectors or markets described in this article were or will be profitable.

Order fulfillment in supply chain management involves the end-to-end process of handling customer orders, from receiving and processing them to shipping and delivering the products. It covers tasks like managing inventory and coordinating shipments to ensure timely delivery and customer satisfaction. Poor inventory management can lead to stock outs or overstocking, negatively impacting order fulfillment. Without accurate inventory tracking, businesses may struggle to fulfill orders on time, resulting in customer dissatisfaction. In the drop shipping model, products are shipped directly from the manufacturer to the customer, bypassing the retailer’s inventory. This reduces overhead costs and is especially useful for new e-commerce businesses.

Many brokers sell their clients’ orders to market makers who pay the brokers for these orders. The market makers trade with the orders by taking the other side of the trade and thus, establishing an execution price. A Bond Account is a self-directed brokerage account with Public Investing. Deposits into this account are used to purchase 10 investment-grade and high-yield bonds. The Bond Account’s yield is the average, annualized yield to worst (YTW) across all ten bonds in the Bond Account, before fees. A bond’s yield is a function of its market price, which can fluctuate; therefore a bond’s YTW is not “locked in” until the bond is purchased, and your yield at time of purchase may be different from the yield shown here.