Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received turbotax itsdeductible his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses.

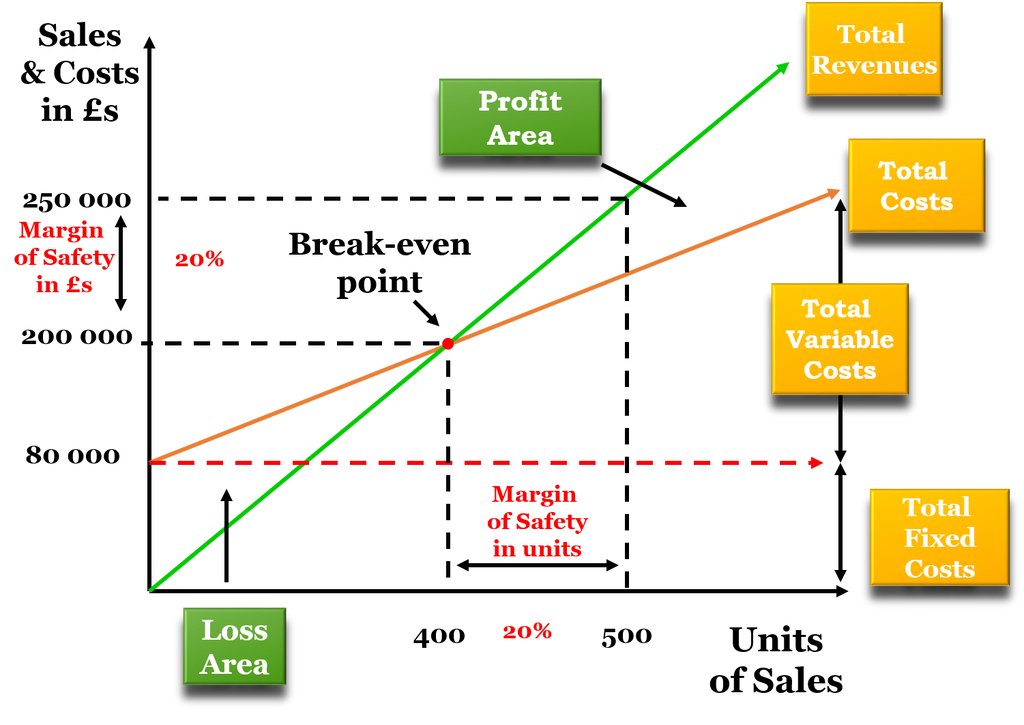

- The break-even point or cost-volume-profit relationship can also be examined using graphs.

- At the break-even point, the total cost and selling price are equal, and the firm neither gains nor losses.

- Break-even analysis compares income from sales to the fixed costs of doing business.

- As we can see from the sensitivity table, the company operates at a loss until it begins to sell products in quantities in excess of 5k.

- But at least it gives you a way to begin your search for the “best” price for your product.

Advanced Functions of the Online Breakeven Calculator with Graphs

The total cost line is the sum total of fixed cost ($3,000) and variable cost of $15 per unit, plotted for various quantities of units to be sold. The break-even point is the point at which the total cost of production equals the total revenue generated. It is only possible for a small business to pass the break-even point when the dollar value of sales is greater than the fixed + variable cost per unit. So, to cover all fixed costs, the first company managers should sell more than 6,667 units of the product or attract 6,667 customers to the service. The break-even point is this example is 100,000 units because it is the output level at which the total revenue and total cost curves intersect. Its fixed costs are $200,000 per cab per annum and its variable operating costs are $3 per kilometer.

What is the basic objective of break-even point analysis?

The breakeven point is important because it identifies the minimum sales volume needed to cover all costs, ensuring no losses are incurred. It aids in strategic decision-making regarding pricing, cost control, and sales targets. If the stock is trading at a market price of $170, for example, the trader has a profit of $6 (breakeven of $176 minus the current market price of $170). Assume that an investor pays a $5 premium for an Apple stock (AAPL) call option with a $170 strike price. This means that the investor has the right to buy 100 shares of Apple at $170 per share at any time before the options expire.

How to Calculate Break-Even Point (BEP)

Easily calculate the break even point for any product or service and generate a graph with the break-even point. Estimate how many units you need to sell before you break even, covering both your fixed and variable costs, and how long it would take you. Break-even analysis compares income from sales to the fixed costs of doing business.

Retirement Calculators

Did you know that 30% of operating small businesses are losing money? You have to plan ahead carefully to break-even or be profitable in the long run. So, the number of units that need to be sold at the break-even point becomes. ExcelDemy is a place where you can learn Excel, and get solutions to your Excel & Excel VBA-related problems, Data Analysis with Excel, etc. We provide tips, how to guide, provide online training, and also provide Excel solutions to your business problems.

Grade & GPA Calculators

This makes it almost impossible to always have a most up-to-date, accurate breakeven point. This margin indicates how much of each unit’s sales revenue contributes to covering fixed costs and generating profit once fixed costs are met. For example, if a product sells for $10 but only incurs $3 of variable costs per unit, the product has a contribution margin of $7. Note that a product’s contribution margin may change (i.e. it may become more or less efficient to manufacture additional goods). The total fixed costs are $50k, and the contribution margin ($) is the difference between the selling price per unit and the variable cost per unit.

It is only useful for determining whether a company is making a profit or not at a given point in time. It is possible to calculate the break-even point for an entire organization or for the specific projects, initiatives, or activities that an organization undertakes. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

Today, 30% of our visitors use Ad-Block to block ads.We understand your pain with ads, but without ads, we won’t be able to provide you with free content soon. If you need our content for work or study, please support our efforts and disable AdBlock for our site. A lender or investor will probably want to see this information in the financial report section of your business plan. Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. Or, if using Excel, the break-even point can be calculated using the “Goal Seek” function.

Let’s find the minimum number of kilometers which the cabs must be plied or the company will suffer a loss. Alternatively, the break-even point can also be calculated by dividing the fixed costs by the contribution margin. The Break-Even Point (BEP) is the inflection point at which the revenue output of a company is equal to its total costs and starts to generate a profit. Calculating the break-even point helps you determine how much you will have to sell before you can make profit. Knowing this, you can then regulate your marketing activity if you decide your sales are lower than expected, or just wish to reach the target sooner.